Financial planning has never been more important than it is in 2025. With rising living costs, fluctuating markets, and major shifts in employment and technology, individuals and families are reassessing how they save, invest, and prepare for the future. Whether your goal is to buy a home, grow your savings, eliminate debt, or achieve financial independence, this comprehensive guide will walk you through every essential part of financial planning in 2025 — supported by powerful free financial tools and calculators you can use instantly.

What Is Financial Planning and Why It Matters in 2025

Financial planning is about understanding how your income, expenses, savings, investments, and long-term goals fit together to build financial stability.

In 2025, external factors such as rising interest rates, inflation, and evolving job markets have made financial planning more crucial than ever.

A well-built financial plan helps you:

- Prepare for emergencies

- Build long-term wealth

- Reduce debt strategically

- Make informed financial decisions

- Save for major life milestones

- Protect your family’s future

Throughout this guide, we’ll include links to relevant free calculators that support each step of your planning.

Step 1: Understand Your Current Financial Position

You cannot build a strong financial plan without first understanding:

- Your actual income

- Your monthly expenses

- Your debts

- Your existing savings

- Your investment portfolio

- Your credit score

This becomes your financial baseline.

Calculate Your Real Income

Most people only consider their gross salary, not their actual take-home pay after taxes, pension, and deductions. Gather your pay stubs to get accurate take-home pay after taxes and deductions.

This gives a realistic foundation for your budgeting.

Understand Your Monthly Spending

Review your last 3–6 months of bank statements to see:

- Subscription costs

- Food & travel expenses

- Lifestyle spending

- Unexpected charges

This helps uncover hidden spending and create a better plan.

Assess Your Debt

List all debts with:

- Interest rates

- Monthly payments

- Outstanding balances

- Remaining term

You will use these values later when planning repayment.

Step 2: Build a Realistic Budget and Spending Plan

Budgeting doesn’t have to feel restrictive. The goal is to use your money with intention.

The popular 50/30/20 rule works for many people:

- 50% Essentials (housing, food, bills)

- 30% Lifestyle

- 20% Savings & debt repayment

Adjust the ratios based on your needs — especially if you live in a high-cost area.

2025 Budgeting Tips

- Automate savings and bills

- Track subscriptions

- Review spending quarterly

- Limit lifestyle inflation

- Use a budgeting app or spreadsheet

Budgeting is the foundation of long-term financial stability.

Step 3: Build a Strong Emergency Fund

An emergency fund protects you from financial shocks such as job loss, car repairs, medical expenses, or urgent travel.

Recommended Emergency Fund Levels:

- Minimum: 1 month

- Good: 3 months

- Strong: 6 months

- Ideal: 12 months (if self-employed, parent, or single-income household)

Calculate your projected savings growth to determine your monthly targets.

This helps you determine how much to save monthly and when you’ll hit your goal.

Step 4: Pay Down High-Interest Debt Strategically

High-interest debt — especially credit cards — is one of the biggest obstacles to financial freedom.

Two Effective Debt Repayment Methods

1. Avalanche Method

Pay highest-interest debt first to save the most money.

2. Snowball Method

Pay smallest balance first to build momentum.

| Consult with a financial advisor to estimate repayment timelines, interest costs, and monthly payments. If you have a car loan or finance agreement, get quotes from multiple lenders to compare your finance agreement options. These steps make repayment planning simple and precise. |

These tools make repayment planning simple and precise.

Step 5: Plan for Short-Term Goals (1–5 Years)

Short-term financial goals might include:

- Travelling

- Saving for a car

- Home improvements

- Building a business

- Emergency fund expansion

These goals keep you motivated and build financial discipline.

Track your percentage of progress toward savings targets and price changes.

It’s excellent for calculating down payments and goal percentages.

Step 6: Plan for Long-Term Goals (5–30 Years)

Long-term goals require a structured savings and investment strategy.

These goals could include:

- Buying a home

- Paying off a mortgage

- Building investment wealth

- Saving for children

- Achieving financial independence

- Retirement planning

Home Buying Goals

Consult a pre-approval advisor to estimate monthly repayments and determine how much home you can safely afford.

Speak with a lender to check your borrowing readiness and your Debt-to-Income (DTI) ratio.

Investing in 2025 — What’s Changed?

Investing is the key to long-term wealth. In 2025, investing is easier than ever due to:

- Fractional shares

- Low-cost index funds

- Commission-free apps

- Automated investing

- Digital wealth platforms

- AI investment advice

Best Investment Options in 2025

- Index funds

- ETFs

- Real estate

- Government bonds

- REITs

- Dividend stocks

- Retirement accounts

Work with a platform’s projection tool to project returns based on contributions and expected interest rates, and see real compounding growth.

Preparing for Retirement in 2025 and Beyond

Retirement planning has become more important due to inflation and longer life expectancy. A common rule for estimating retirement needs is: Save 25× your annual expenses (Essentially, the 4% rule.) Consult a financial planner to determine your retirement savings target. This gives you a personalised roadmap to retirement success.

Protecting Your Financial Future — Insurance & Risk Management

Insurance ensures that your financial plan doesn’t collapse during unexpected events.

Key types include:

- Life insurance

- Income protection

- Critical illness cover

- Car insurance

- Home insurance

- Health insurance

Evaluate your family’s needs based on income, lifestyle, and dependents.

Improve Your Credit Score in 2025 for Better Financial Opportunities

A higher credit score means:

- Lower interest rates

- Better mortgage deals

- Cheaper car finance

- Higher chances of loan approval

Tips to Boost Your Credit Score

- Pay bills on time

- Reduce credit utilisation

- Keep old accounts open

- Avoid multiple credit applications

- Dispute inaccuracies on your credit report

- Reduce debt using structured repayment plans

Monitor your credit report to check borrowing strength and your Debt-to-Income (DTI) ratio.

Use Our Free Tools to Execute Your Strategy

To apply the powerful strategies and concepts discussed in this guide, you need accurate numbers.

We’ve built a complete suite of Free Online Calculators designed to turn your financial strategy into immediate, actionable steps, from calculating your tax liability to projecting your retirement savings.

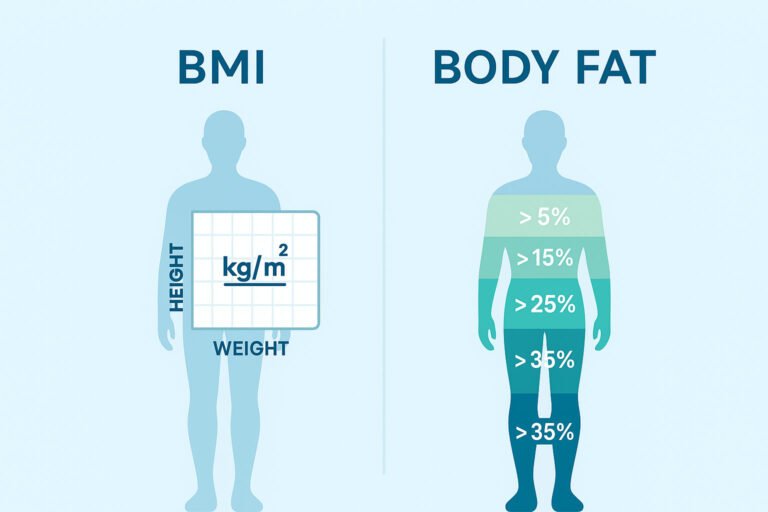

⭐ Access All 21 Free Financial & Health Calculators Here: https://diumitra.com/tools/