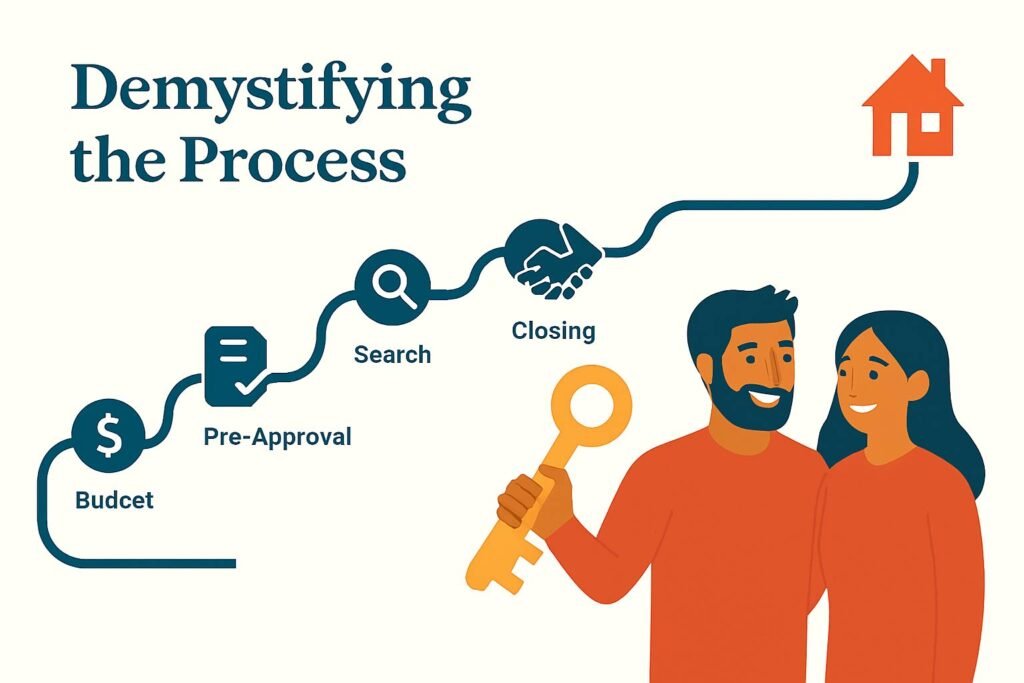

Welcome to the Ultimate Guide to Buying Your First Home. If you’re a first-time buyer, this Ultimate Guide to Buying Your First Home will walk you step by step through budgeting, mortgage pre-approval, house hunting, inspections, and closing. The home-buying process can feel overwhelming, but with this guide, you’ll learn everything you need to move forward with confidence.

Understanding the Home-Buying Process for First-Time Home Buyers

The home-buying process can be intricate and daunting, especially for first-time buyers. However, breaking it down into key stages can make it more manageable and less overwhelming. The journey typically begins with securing pre-approval for a mortgage, which provides an estimate of how much a lender is willing to finance. This step is crucial, as it allows buyers to understand their budget and empowers them to make informed decisions during their search for a home.

Once the pre-approval is obtained, the next phase involves house hunting. This stage requires careful consideration of various factors including location, price range, and the features desired in a home. Potential buyers often benefit from creating a checklist of essential amenities and preferences to guide their search. Engaging a real estate agent can also provide valuable insights and facilitate access to listings that may not be readily available to the public.

After identifying a suitable property, the next step is making an offer. This is a critical component of the home-buying process, as a well-structured offer can make a significant difference in the outcome. Buyers should consider local market conditions when determining their offer price, taking into account the pricing trends of comparable homes in the area. Negotiation may follow, culminating in an acceptance from the seller.

Finally, the process concludes with the closing stage, which involves finalizing the sale. This step includes extensive paperwork, inspections, and financing arrangements. It is essential for buyers to perform due diligence to ensure there are no unexpected issues with the property. Each of these key steps—pre-approval, house hunting, making an offer, and closing—plays a pivotal role in the overall journey of purchasing a home and contributes to a positive and rewarding home-buying experience.

Setting a Budget When Buying Your First Home

Embarking on the journey of homeownership necessitates a thorough understanding of your financial health. Assessing various financial aspects such as your income, debts, and credit score is pivotal in forming a suitable budget for your home purchase. To start, it is crucial to evaluate your income sources, including salary, bonuses, and any additional income from side jobs or investments. This comprehensive assessment provides a clearer picture of how much you can afford to allocate towards a mortgage each month.

Next, it is essential to calculate your debt-to-income (DTI) ratio. This ratio, which compares your monthly debt obligations to your gross monthly income, plays a significant role in determining your mortgage eligibility. Most lenders prefer a DTI ratio of 36% or lower, ensuring borrowers do not overextend themselves financially. By calculating this ratio, you can gain insight into your borrowing capacity and set boundaries for your home purchase budget.

Your credit score is another critical component in understanding your financial situation. Lenders use this score to evaluate your creditworthiness, impacting your loan terms and interest rates. A higher credit score can lead to better loan offers, thereby influencing the total cost of your new home. It is advisable to review your credit report for accuracy and take steps to improve your score, if necessary, before initiating the home-buying process.

When setting your budget, it is also vital to consider additional costs associated with homeownership, including property taxes, homeowners insurance, and maintenance expenses. These costs can add a significant amount to your monthly expenses and should be factored into your overall budget. By comprehensively understanding your financial situation, you will be more equipped to set a realistic budget, which is essential for a successful home-buying experience.

Mortgage Pre-Approval Tips for First-Time Buyers

Obtaining a mortgage pre-approval is a pivotal step in the home-buying process, as it provides a clearer picture of your financial situation and purchasing power. Unlike pre-qualification, which offers a general estimate of how much you might be able to borrow based on self-reported financial information, pre-approval involves a thorough assessment by a lender. This process includes a deep dive into your credit history, income verification, and assessments of your debts, enabling lenders to provide a more accurate estimate of your mortgage eligibility and potential loan amount.

The pre-approval process not only enhances your credibility as a buyer but also streamlines your search for a home. Sellers often look favorably upon buyers who are pre-approved, as it indicates that they are serious and financially capable of closing the deal. To secure pre-approval, potential buyers need to gather essential documentation, such as proof of income, tax returns, bank statements, and identification. Following this, you will submit an application to a lender, who will then evaluate your financial profile before issuing a pre-approval letter.

When considering a mortgage, it is crucial to understand the different types available. Fixed-rate mortgages offer predictability in payments, as the interest rate remains stable for the duration of the loan. On the other hand, adjustable-rate mortgages (ARMs) may offer lower initial rates, but they can fluctuate over time based on market conditions. Additionally, government-backed loans, such as FHA and VA loans, may provide more flexible qualifying criteria and lower down payment options—ideal for first-time buyers.

Ultimately, choosing the right mortgage depends on your financial situation, long-term plans, and risk tolerance. In blending these factors with your pre-approval, you will be well-equipped to make informed decisions on your journey to homeownership.

How to Choose a Real Estate Agent When Buying Your First Home

One of the most critical steps in the home-buying process is selecting a real estate agent who aligns with your needs and objectives. A knowledgeable agent can simplify the often complex home-buying journey and provide invaluable insights into the local market. When searching for a real estate agent, consider their experience, communication style, and commitment to understanding your specific preferences.

Start by seeking recommendations from friends, family, or colleagues who have recently navigated the real estate market. This firsthand experience can help you compile a list of potential agents. Once you have a few candidates, it is essential to conduct interviews to gauge their expertise and compatibility with your goals. Prepare a list of questions covering topics such as their experience with first-time home buyers, knowledge of your desired neighborhoods, and availability for showings and consultations.

During the interview, pay attention to whether the agent listens carefully to your needs and responds thoughtfully. A good real estate agent should not only possess market knowledge but also demonstrate genuine interest in helping you find the right home. Furthermore, inquire about their approach to negotiation and how they plan to advocate for your interests throughout the buying process. Understanding their strategies can provide insight into their effectiveness as an advocate on your behalf.

Moreover, consider the advantages of hiring a professional guide. A skilled real estate agent can provide access to listings before they hit the market, offer valuable advice on property valuations, and help navigate complex documentation that comes with purchasing a home. Their expertise can ultimately save you time, effort, and potential pitfalls. As you weigh your options, choosing the right agent can significantly enhance your home-buying experience and lead to a successful outcome.

House-Hunting Tips: How to Find the Right Home

The journey of finding your dream home can be both exhilarating and overwhelming, especially for first-time buyers. Setting clear priorities is a crucial starting point. Begin by distinguishing between your wants and needs. A “want” might be a home with a pool, while a “need” could be a minimum number of bedrooms or proximity to public transport. Creating a list that categorizes these factors will help streamline your search and keep you focused on properties that meet your essential criteria.

Utilizing online tools can significantly enhance the home search process. Websites such as Zillow, Realtor.com, and local MLS services allow buyers to filter properties based on specific criteria like price, location, and amenities. Additionally, these platforms offer virtual tours and neighborhood insights, which can help inform your decisions without needing to visit every listing in person. Bookmarking your favorite properties and comparing them side-by-side can prove helpful as you refine your options.

Attending open houses is another effective strategy for first-time home buyers. These events not only allow you to explore the properties but also provide an opportunity to observe the local area and gauge the overall vibe of the neighborhood. Engaging with the hosting agents can yield useful insights regarding the property’s history and surrounding community, thus aiding in your decision-making process.

As you navigate through potential homes, it is essential to recognize red flags. Signs of water damage, strange odors, or signs of pest infestations should prompt further investigation. Addressing these concerns early on can save you from costly repairs and unfortunate surprises after the purchase. Balancing your desires for the perfect home with practical considerations will ultimately lead you to a fulfilling and wise investment in your future.

How to Make an Offer When Buying Your First Home

Making an effective offer on a home is a crucial step in the home-buying process. Understanding how to determine an appropriate offer price is foundational to this negotiation. First, it is essential to conduct thorough market research, analyzing recent sales of comparable properties in the area. This will give you insight into the current market conditions, helping you identify a fair price that reflects the home’s value. A real estate agent can be invaluable in this stage, providing expert opinions based on their experience and access to relevant data.

Once you have established a potential offer price, consider incorporating contingencies in your purchase offer. Contingencies are conditions that must be met for the sale to finalize, such as securing financing, conducting a satisfactory home inspection, or the sale of your current home. Contingencies protect your interests and provide you with an exit strategy if unforeseen issues arise. Crafting an offer with suitable contingencies can reassure both parties that the transaction is manageable and reasonable.

Next, negotiation is an art that significantly influences the outcome of your offer. When negotiating with the seller, it is essential to remain calm and composed. Start with a reasonable offer, but be prepared to counter and adjust based on the seller’s response. A good negotiation strategy includes maintaining open communication and being flexible where possible, such as adjusting the closing date or offering to cover specific costs. Remember, the goal is to reach a mutually beneficial agreement while securing your dream home at an agreeable price.

Lastly, substantiating your offer with a personal touch can make a difference. Consider writing a heartfelt letter to the seller, expressing your appreciation for the home and emphasizing your commitment to maintaining it. This can resonate well with sellers on an emotional level, possibly swaying their decision in your favor amidst competing offers.

Home Inspection & Appraisal Guide for First-Time Buyers

The home inspection and appraisal process plays a crucial role in the home-buying journey, particularly for first-time buyers. A home inspection is a thorough examination of the property’s condition, conducted by a certified professional. This examination typically covers structural elements, plumbing, electrical systems, and roofing, among other critical areas. Home buyers are encouraged to accompany the inspector to gain insights and firsthand knowledge about the property’s condition. Key issues to look out for include signs of water damage, roof integrity, and the overall state of major systems, as these can influence both the safety and satisfaction of living in the home.

Following the inspection, buyers should receive a detailed report highlighting any discovered issues. It is important for buyers to understand that while no home is without flaws, significant problems can warrant further negotiation with the seller. Addressing these issues proactively can save future costs and ensure the home is a sound investment.

On the other hand, an appraisal is a separate process that determines the market value of the home. Conducted by a licensed appraiser, the appraisal involves a comprehensive evaluation of the property based on several factors. These include recent comparable sales in the neighborhood, property condition, and market trends. The appraisal is essential, as it protects both the lender and the buyer by ensuring that the home is worth the investment being made.

The appraisal can also impact financing; if the appraised value is lower than the agreed purchase price, the buyer may need to renegotiate with the seller or provide a larger down payment. Home inspections and appraisals are integral to the home-buying process, providing vital information that aids informed decision-making and assists in attaining a fair price for the property.

Closing on a House: Final Steps to Buying Your First Home

As you approach the final stage of your home-buying journey, understanding the closing process is essential. Closing day is when the property officially becomes yours, and it involves several key steps that typically occur in a structured manner. Generally, you will meet with the seller, real estate agents, attorneys, and possibly a lender representative. The first part of this meeting will involve confirming that all conditions from the purchase agreement have been met.

One of the most critical aspects of closing is the review of documents. Buyers should take the time to carefully go through the closing disclosure, which outlines the loan terms, monthly payments, and all closing costs. It’s crucial to ensure that these figures match your expectations and the initial estimates provided during the mortgage process. If you notice discrepancies, raise these concerns immediately to avoid complications.

Closing costs can also be a source of anxiety for first-time home buyers. These costs can vary widely but typically range from 2% to 5% of the purchase price. Common closing costs include origination fees, title search fees, and pre-paid taxes and insurance, all of which should be clearly detailed in your closing disclosure. Understanding these fees allows you to prepare your budget accordingly, mitigating last-minute surprises.

On closing day, you will need to bring certain documents and funds, often in the form of a cashier’s check or wire transfer, for any remaining costs. After all documents are signed, funds are disbursed, and the keys to your new home are handed over, the property is officially yours. This moment marks the culmination of your effort and planning as you transition from a prospective buyer to a proud homeowner.

After You Buy Your First Home: Moving & Maintenance Tips

After the closing on your new home, the exciting journey of settling in begins. Moving in can often feel overwhelming, so it’s advisable to break the process down into manageable steps. Start by prioritizing the unpacking of essential items to establish a functional living space. This can include setting up your kitchen, bedrooms, and bathrooms, which will provide a sense of normalcy amidst the chaos of boxes.

Equally important is ensuring that all vital utilities are set up. Contact local service providers to install electricity, water, gas, internet, and cable services. Make sure to verify that these connections are active before your move-in date to avoid disruption, especially if you are moving during inclement weather or other unforeseen circumstances.

Furthermore, establishing a maintenance schedule is crucial for the long-term well-being of your home. Regular inspections and maintenance can prevent minor issues from escalating into significant repairs. A good rule of thumb is to conduct seasonal maintenance checks, which can include gutter cleaning, HVAC servicing, and inspecting smoke detectors. This proactive approach will help you preserve the home’s integrity and reduce unexpected costs.

Managing finances effectively after purchasing a home can significantly impact your overall investment. It is essential to budget for ongoing expenses such as property taxes, homeowner’s insurance, and maintenance fees. Consider setting aside an emergency fund specifically designated for unforeseen repairs or urgent needs that may arise. Another critical component is building equity; this can be achieved through timely mortgage payments and regular home improvements, which enhance the property’s overall value.

With these strategies in place, settling into your new home can be a rewarding experience, laying the foundation for a thriving environment and financial stability in the years to come.

Frequently Asked Questions

Got questions? We’ve answered the most common ones below—so you can get clear, confident guidance without the guesswork.